Startups

Revolutionizing My Business: A Net-30 Journey

Entrepreneurship is often romanticized as a journey dependent solely on the founder’s personal qualities like innovativeness and grit. However, the reality is far more complex and revolves around practical factors such as cash flow management.

During the early days of operating a sign shop in Idaho, the founder realized that the success of a business is intricately tied to its cash flow and the ability to stretch a dollar for as long as possible.

The Valuable Lesson from a Vendor’s Joke

As a new business owner, facing financial constraints and uncertainty, the founder learned a crucial lesson from a vendor’s joke about the importance of trust in entrepreneurship. This paved the way for understanding the significance of building relationships based on reliability and integrity.

Establishing net-30 terms with suppliers provided the founder with the necessary flexibility to manage expenses and payments, enabling the business to operate smoothly without the burden of upfront costs.

The Benefits of Net-30 for Small Business Owners

For entrepreneurs relying on hard work and determination, net-30 terms offer invaluable advantages such as bridging financial gaps, interest-free leverage, and the ability to take on more projects without financial constraints.

Moreover, the founder discovered that timely payments under net-30 agreements contribute to building a positive business credit history, essential for future financial opportunities and growth.

Proactively Building Business Credit

One crucial insight gained was the importance of selecting suppliers who report net-30 payments to business credit bureaus, enhancing the business’s credit profile and opening doors to further financial possibilities.

By consistently meeting payment obligations and nurturing relationships with suppliers, entrepreneurs can lay a strong foundation for long-term financial stability and growth.

Turning Net-30 into a Business Strategy

Utilizing net-30 payment terms goes beyond financial management; it instills a culture of reliability, integrity, and trust within the business. This approach not only secures immediate operational needs but also sets the stage for future opportunities and partnerships.

Ultimately, understanding the flow of money in a business and leveraging tools like net-30 can significantly impact the business’s trajectory, from surviving day-to-day challenges to seizing growth opportunities.

Entrepreneurs are encouraged to prioritize building trust through timely payments and utilizing vendor credit strategically to establish a thriving and sustainable business.

Image by rawpixel.com on Freepik

“Can you please help me with this task?”

to

“Could you assist me with this task, please?”

-

Facebook4 months ago

Facebook4 months agoEU Takes Action Against Instagram and Facebook for Violating Illegal Content Rules

-

Facebook4 months ago

Facebook4 months agoWarning: Facebook Creators Face Monetization Loss for Stealing and Reposting Videos

-

Facebook4 months ago

Facebook4 months agoFacebook Compliance: ICE-tracking Page Removed After US Government Intervention

-

Facebook4 months ago

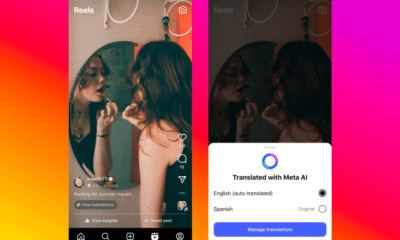

Facebook4 months agoInstaDub: Meta’s AI Translation Tool for Instagram Videos

-

Facebook2 months ago

Facebook2 months agoFacebook’s New Look: A Blend of Instagram’s Style

-

Facebook2 months ago

Facebook2 months agoFacebook and Instagram to Reduce Personalized Ads for European Users

-

Facebook2 months ago

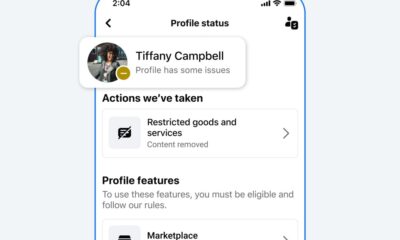

Facebook2 months agoReclaim Your Account: Facebook and Instagram Launch New Hub for Account Recovery

-

Apple4 months ago

Apple4 months agoMeta discontinues Messenger apps for Windows and macOS