Inovation

AI: The Ultimate Weapon in the Battle Against Money Laundering

AI’s Role in Detecting Money Laundering Activities

Money laundering, the process of disguising illicit funds as legitimate income, poses a significant challenge in the financial world. Criminals often resort to sophisticated methods to conceal the origins of their dirty cash, making it imperative for institutions to adopt advanced technologies to combat this criminal activity.

Dr Martin Lukavec, a Senior Lecturer at the renowned London School of Business and Finance, delves into the realm of artificial intelligence (AI) and its ability to trace money laundering activities, offering a glimpse into a more secure future.

Traditionally, money launderers would employ tactics such as routing cash through shell firms and fake invoices to legitimize their ill-gotten gains. However, with the advent of digital payment methods like prepaid debit cards, peer-to-peer apps, and crypto wallets, the landscape of money laundering has evolved, posing new challenges for financial institutions.

AI emerges as a game-changer in the fight against money laundering, replacing rigid rule-based systems with pattern-recognition algorithms. By analyzing a vast array of financial data, AI can identify suspicious patterns and connections that would go unnoticed by human analysts. This shift from a transaction-centric approach to a network-focused strategy allows AI to uncover intricate money laundering schemes.

Unveiling the Hidden Networks

Graph analytics play a pivotal role in transforming raw data into actionable insights. By visualizing financial relationships as interconnected nodes and links, AI can uncover complex networks of illicit transactions. Triangles of rapid payments, circular flows of funds, and clusters of suspicious entities become visible, enabling AI to detect potential money laundering activities with unprecedented accuracy.

While AI shows promising results in identifying illicit flows, challenges persist in dealing with ambiguous data inputs. Algorithms must learn from incomplete information, relying on techniques like positive-unlabelled learning and weak supervision to make informed decisions. Graph neural networks (GNNs) offer a more nuanced approach, learning directly from patterns of interaction to detect anomalies in uncertain data.

Challenges and Future Prospects

Despite the advancements in AI technology, money laundering remains a persistent threat in the financial sector. Criminals constantly adapt their tactics to evade detection, posing a continuous challenge for regulators and law enforcement agencies. While AI can significantly enhance the detection capabilities of financial institutions, a collaborative effort involving both human expertise and technological innovation is essential to combat money laundering effectively.

As the cat-and-mouse game between regulators and wrongdoers continues, AI serves as a valuable tool in raising the stakes for criminals and narrowing their window of opportunity. While AI may not eradicate money laundering entirely, its ability to analyze vast amounts of data and uncover hidden patterns offers a glimmer of hope in the ongoing battle against financial crime.

-

Facebook4 months ago

Facebook4 months agoEU Takes Action Against Instagram and Facebook for Violating Illegal Content Rules

-

Facebook4 months ago

Facebook4 months agoWarning: Facebook Creators Face Monetization Loss for Stealing and Reposting Videos

-

Facebook4 months ago

Facebook4 months agoFacebook Compliance: ICE-tracking Page Removed After US Government Intervention

-

Facebook4 months ago

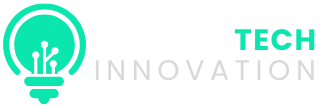

Facebook4 months agoInstaDub: Meta’s AI Translation Tool for Instagram Videos

-

Facebook2 months ago

Facebook2 months agoFacebook’s New Look: A Blend of Instagram’s Style

-

Facebook2 months ago

Facebook2 months agoFacebook and Instagram to Reduce Personalized Ads for European Users

-

Facebook2 months ago

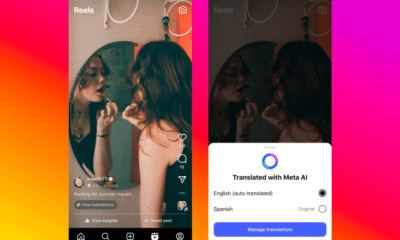

Facebook2 months agoReclaim Your Account: Facebook and Instagram Launch New Hub for Account Recovery

-

Apple4 months ago

Apple4 months agoMeta discontinues Messenger apps for Windows and macOS