Startups

Automating Your Savings: The Key to Financial Success

When it comes to saving money, the concept may seem straightforward in theory but challenging in practice. You may have the intention to set money aside, but life always seems to get in the way. Unexpected expenses arise, priorities change, and whatever is left at the end of the month never seems to be sufficient. However, by putting your savings on autopilot, you can change this dynamic by eliminating the need for constant decision-making. Instead of relying on willpower, you can establish a system that quietly works in the background.

Many individuals turn to automation after realizing that manual saving is inconsistent. This realization often occurs during stressful times when finances feel tight and progress seems slow. Some may even begin exploring options like debt relief in Massachusetts as they search for ways to regain control and create financial breathing room. Automation is not a shortcut, but rather a stabilizer. It ensures that saving occurs even when motivation fluctuates.

Autopilot saving is more about reliability than sophistication. When money is automatically moved, habits form effortlessly, making it easier to reach long-term financial goals.

Why Automation Is More Effective Than Intentions

Most people do not struggle to save due to a lack of discipline but rather because saving competes with numerous other financial decisions. Every purchase, bill, and unexpected expense draw from the same pool of attention. Automation removes saving from this competition by scheduling transfers to occur as soon as income is received, prioritizing your future self before spending begins. This approach flips the usual order and safeguards savings from impulsive decisions. Once automated, saving becomes a predictable necessity rather than an optional choice.

Starting Small to Gain Momentum

One common misconception about automated saving is that it requires large sums of money. In reality, consistency is more critical than the amount saved. Even small transfers can build momentum. Beginning with modest amounts reduces resistance, making it easier to commit to and maintain the habit. As income increases or expenses decrease over time, these amounts can be adjusted upward. The foundation of the habit itself is what matters most, with growth following consistency.

Choosing the Right Accounts for Automation

The destination of your automated savings is crucial. Depending on your goals, automated savings can be directed to various accounts. Short-term savings are best kept in high-yield savings accounts for accessibility, while long-term goals may be supported by retirement or investment accounts. Separating goals into distinct accounts adds clarity and motivation, giving purpose to the automation process rather than making it feel abstract.

Timing Transfers for Optimal Effectiveness

The timing of transfers plays a significant role in the success of autopilot saving. Scheduling transfers immediately after receiving your paycheck reduces the temptation to spend before saving. By ensuring that money never sits idly in your checking account, you are less likely to use it for discretionary spending. This timing reinforces the idea that saving is a priority, not an afterthought, and strengthens the habit through consistency.

Using Automation to Alleviate Financial Stress

One of the primary benefits of automated saving is the reduction of financial stress. When savings grow automatically, there is less anxiety about falling behind on your financial goals. Knowing that progress is being made regardless of your busy schedule or emotional fluctuations provides a sense of reassurance. This stability supports better decision-making across all aspects of your finances, making stress reduction a valuable outcome of automation.

Adjusting Automation as Your Life Changes

Automation is not a “set it and forget it” solution. It works best when reviewed periodically. Changes in income, shifting expenses, and evolving goals necessitate a review of automated transfers quarterly or annually to ensure they align with your current financial situation. Making adjustments is a sign of engagement, not failure, and allows your automated savings to adapt to your changing circumstances.

Avoiding Common Pitfalls in Automation

While automation is a powerful tool, it can backfire if not set up correctly. Over-automating without sufficient cash flow can lead to overdrafts or reliance on credit. The key is to strike a balance by leaving enough flexibility in your checking account to cover essential expenses and building buffers before increasing automated savings amounts. Automation should enhance financial stability, not introduce new sources of stress.

Combining Automation with Awareness

Autopilot saving should not replace awareness but rather complement it. Periodic check-ins help ensure that your automated systems are functioning as intended. Reviewing your account balances and progress reinforces motivation and celebrates your successes. By staying aware, you keep your automation purposeful rather than passive, allowing you to make informed financial decisions confidently. Utilizing trusted resources, such as the Consumer Financial Protection Bureau, for guidance on automating savings can further support your financial management strategy.

Expanding Automation Beyond Traditional Savings

Automating your savings can extend beyond basic accounts to include retirement contributions, health savings accounts, and investment plans. Each automated contribution reduces friction and increases consistency in your financial habits. Over time, these automated systems work together to bolster long-term financial stability. By wisely automating various aspects of your finances, you reduce the need to make stressful decisions under pressure.

Building Confidence Through Predictability

Predictability is a fundamental aspect of financial confidence. When savings occur automatically, progress becomes measurable and reliable, instilling a sense of confidence. This newfound confidence can spill over into other areas of your financial life, making you more comfortable setting goals, making plans, and navigating setbacks. Autopilot savings create a sense of control even in uncertain times.

Understanding the Long-Term Benefits

Automated savings quietly compound over time. Small, consistent contributions grow into substantial reserves over the years. The power lies in the duration of automation – the earlier you start, the more time works in your favor. This long-term perspective shifts your focus from short-term sacrifices to long-term financial stability.

Utilizing Trusted Resources to Optimize Automation

Seeking reliable guidance can help refine your automation strategies. Neutral, educational sources offer frameworks without pressure, empowering you to make informed decisions. Organizations like the Federal Reserve provide consumer education on household finances, including saving strategies and account management, to help you strengthen your financial systems.

Autopilot as a Form of Self-Trust

Placing your savings on autopilot is an act of self-trust. It acknowledges that motivation can vary and establishes a system that works consistently, regardless of external factors. This approach respects human behavior instead of resisting it, facilitating progress without constant effort. Saving becomes a proactive measure that benefits you, rather than a reactive pursuit.

Transforming Automation into a Long-Term Asset

Although savings automation may not provide immediate gratification or flashy results, it offers something far more valuable – reliability. Over months and years, automated savings transform intentions into tangible outcomes, building reserves, supporting goals, and reducing financial stress. With your savings quietly running in the background, you are free to focus on living your life rather than constantly micromanaging your finances. Placing your savings on autopilot is not about relinquishing control but rather designing a sustainable system of control that endures.

-

Facebook4 months ago

Facebook4 months agoEU Takes Action Against Instagram and Facebook for Violating Illegal Content Rules

-

Facebook4 months ago

Facebook4 months agoWarning: Facebook Creators Face Monetization Loss for Stealing and Reposting Videos

-

Facebook4 months ago

Facebook4 months agoFacebook Compliance: ICE-tracking Page Removed After US Government Intervention

-

Facebook4 months ago

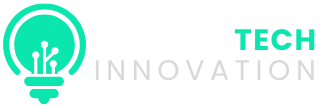

Facebook4 months agoInstaDub: Meta’s AI Translation Tool for Instagram Videos

-

Facebook2 months ago

Facebook2 months agoFacebook’s New Look: A Blend of Instagram’s Style

-

Facebook2 months ago

Facebook2 months agoFacebook and Instagram to Reduce Personalized Ads for European Users

-

Facebook2 months ago

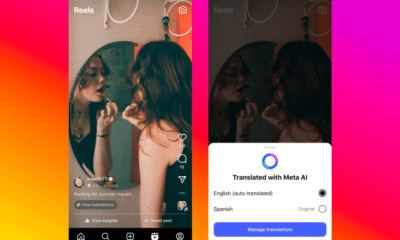

Facebook2 months agoReclaim Your Account: Facebook and Instagram Launch New Hub for Account Recovery

-

Apple4 months ago

Apple4 months agoMeta discontinues Messenger apps for Windows and macOS