Startups

The Illusion of Bootstrapping: A Closer Look

There’s a reason founders romanticize suffering. You get to say you “did it all yourself.” Your startup was forged in the fires of grit and ramen noodles. But here’s the truth most people won’t admit: bootstrapping isn’t a badge of honor — it’s a business strategy that often backfires.

The startup world has built a whole mythology around scarcity, pretending that running on fumes is a sign of purity instead of poor planning. At its worst, bootstrapping traps founders in a cycle of burnout, underinvestment, and lost opportunity while they convince themselves they’re staying “authentic.”

The myth of virtuous suffering

Bootstrapping appeals to ego. It’s the hero’s journey narrative for entrepreneurs — the idea that only the toughest, scrappiest, and most self-sacrificing make it to the top. Founders brag about skipping salaries or coding through the night, not realizing they’re glamorizing self-harm disguised as hustle.

The myth thrives because it flatters the founder’s identity: independence becomes synonymous with moral superiority. You’re not just building a product; you’re proving you’re better than the VC-backed crowd.

The problem is that this story blinds people from reality. Capital isn’t corruption — it’s fuel. The moment your competitors take funding, they buy speed, talent, and runway. You, meanwhile, are still hand-wiring growth with duct tape and determination. The longer you stay underfunded, the more your company becomes a treadmill. The pride of self-sufficiency quietly turns into stagnation.

Worse yet, the ecosystem encourages this delusion. Conferences and podcasts glorify the “bootstrap to millions” stories while skipping over how rare and risky they actually are. For every Mailchimp or Basecamp, there are thousands of brilliant founders who ran out of time and cash before traction ever arrived.

When bootstrapping becomes self-sabotage

Despite an unwillingness to admit it, founders often confuse frugality with strategy. Being resourceful is smart; being starved isn’t. Bootstrapping crosses the line when it limits your ability to execute.

Hiring slower, delaying product launches, and skipping vital marketing pushes might feel like “lean” tactics, but they often mean you’re losing ground. When your competitors are iterating weekly and you’re stuck testing manually, the cost of being “self-funded” compounds quietly.

Many founders tell themselves they’re maintaining control. But total ownership doesn’t mean total freedom. Investors can be demanding, sure, but so can a lack of payroll. When every invoice becomes existential, your decisions aren’t made from vision, they’re made from survival. You end up chasing short-term revenue instead of long-term growth because you need cash now.

Bootstrapping is also a psychological trap. It validates suffering as virtue. You start equating exhaustion with success and scarcity with authenticity. But if your startup’s identity depends on staying broke, you’ve built a culture that resists scale. It’s hard to inspire people with a vision when that vision comes attached to endless financial anxiety.

The false freedom of “control”

One of the biggest selling points of bootstrapping is control — no investors breathing down your neck, no board meetings, no dilution. That sounds great until you realize control without leverage is just isolation. You’re responsible for everything: the cash flow, the team morale, the next pivot. Every decision becomes heavier because there’s no safety net and no one else to share the risk.

The illusion of control often hides the truth that bootstrapped founders are still controlled — just by different forces. Instead of investor pressure, they face customer dependency, burnout, and time scarcity. On the other hand, their competitors are busy exploring AI ads, new tech stacks and solutions whose riskiness might prove fruitful in the end.

Real control isn’t about rejecting funding; it’s about choosing the right kind of capital and partnerships. Smart founders use investment as a lever, not a leash.

They pick investors who align with their mission and structure deals that protect their independence while still providing the runway to grow. Bootstrapping might give you 100 percent ownership, but if you’re perpetually fighting for survival, what exactly do you own?

Why founders fear funding

So if bootstrapping is such a trap, why do so many founders still cling to it? Ego definitely plays a role, but fear plays an even bigger one. Taking funding feels like surrendering something sacred — your autonomy, your purity, your narrative.

Founders fear losing control, making bad deals, or being forced into growth-at-all-costs mode. Those are valid concerns, but they’re solvable with due diligence and negotiation.

Another reason is identity. The tech world rewards martyrdom. Founders are conditioned to see suffering as proof of commitment. You don’t just want to win; you want to be the kind of founder who wins the “right” way. That moral framing keeps people trapped in suboptimal choices, with reignited passion being floated as a vague promise. They’ll burn through personal savings, delay hiring, and run on fumes rather than admit they might need help.

Ironically, the same founders who refuse investors often rely on unpaid labor, overworked teams, or cheap contractors — forms of capital extraction that don’t show up on a balance sheet but cost just as much in morale and quality. Pride keeps them poor, both financially and operationally.

We earn a commission if you make a purchase, at no additional cost to you.

We earn a commission if you make a purchase, at no additional cost to you.

Reframing capital as a tool, not a temptation

The healthiest founders see money as a resource, not a moral test. Taking investment doesn’t corrupt your vision — it strengthens your ability to execute it. The point isn’t to raise recklessly, but to raise strategically. What that means is that you must choose funding that matches your growth curve.

The Importance of Strategic Funding in Startup Growth

Securing a well-structured angel round of funding can significantly impact a startup’s growth by enabling the hiring of top talent that accelerates product-market fit. It’s crucial to understand that funding should not be viewed as a shortcut but rather as a multiplier of potential success.

Successful founders are those who view capital as essential as oxygen. Just as one manages breathing wisely, managing capital with prudence is key. The myth of bootstrapping often leads to a culture of austerity, whereas what startups truly need is sustainability. There’s a fine line between being lean and being limited, with the former building resilience and the latter contributing to the high percentage of startup founders facing mental health issues due to excessive pressure.

When a mission holds genuine significance, depriving it of necessary resources is counterproductive. Raising money should not be seen as selling out but rather as a commitment to supporting one’s idea with the resources it deserves.

Final Thoughts on Sustainable Entrepreneurship

True entrepreneurship revolves around building systems that outlast personal endurance rather than enduring unnecessary pain. Knowing when to conserve and when to expand, when to persevere through scarcity, and when to seek assistance are all crucial aspects of sustainable growth. While bootstrapping may serve as a temporary phase, it should not define a startup’s identity.

While founders often emphasize grit, it’s essential to recognize that grit alone is insufficient without leverage. The true measure of success lies in creating something that can scale beyond individual capabilities. This requires humility, acknowledging that money, mentorship, and partnerships are not adversaries of authenticity but rather allies of ambition.

Startup culture does not require more martyrs but rather more architects – individuals who design growth strategies with foresight instead of adhering to outdated notions of noble suffering. Collaboration and smart decision-making are more effective than solitary endeavors. Partnership and humility can pave the way for sustainable growth, whereas pride alone cannot cover essential expenses like AWS bills.

Image by creativeart on Freepik

-

Facebook3 months ago

Facebook3 months agoEU Takes Action Against Instagram and Facebook for Violating Illegal Content Rules

-

Facebook4 months ago

Facebook4 months agoWarning: Facebook Creators Face Monetization Loss for Stealing and Reposting Videos

-

Facebook4 months ago

Facebook4 months agoFacebook Compliance: ICE-tracking Page Removed After US Government Intervention

-

Facebook4 months ago

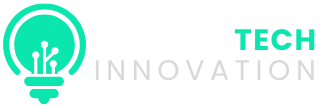

Facebook4 months agoInstaDub: Meta’s AI Translation Tool for Instagram Videos

-

Facebook2 months ago

Facebook2 months agoFacebook’s New Look: A Blend of Instagram’s Style

-

Facebook2 months ago

Facebook2 months agoFacebook and Instagram to Reduce Personalized Ads for European Users

-

Facebook2 months ago

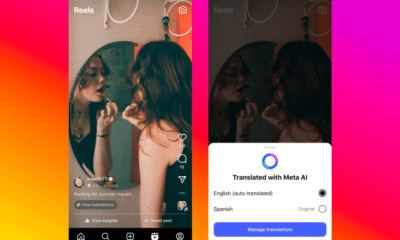

Facebook2 months agoReclaim Your Account: Facebook and Instagram Launch New Hub for Account Recovery

-

Apple4 months ago

Apple4 months agoMeta discontinues Messenger apps for Windows and macOS