Startups

The Revolutionary Impact of AI on Banking and Investment

In the not-so-distant past, funding decisions were made using manual spreadsheets, phone calls, and intuition. However, the landscape has drastically changed with the emergence of artificial intelligence (AI), transforming how capital flows. This has provided investors and banks with instant insights, predictive capabilities, and quicker decision-making processes when it comes to funding small businesses.

The Impact of Advanced AI Analytics on Investment Decisions

Investors now rely heavily on advanced analytics to stay competitive in the market. Cutting-edge platforms analyze vast amounts of financial data and public sentiment in real-time, swiftly identifying trends and uncovering new investment opportunities.

Companies like Affiniti are offering AI-powered CFO agents tailored to the needs of small and mid-sized businesses. These technological advancements empower business owners to make more informed financial decisions while giving investors greater visibility into which ventures are worth supporting.

The Rise of AI in Banking: Expanding Access and Reducing Risk

The adoption of AI among banks has surged, reshaping the landscape of lending and risk management practices. It is estimated that by 2025, over 75% of the largest banks will integrate AI into these processes.

Banks embracing these technologies have seen an increase in lending to borrowers, a reduction in default rates, and more competitive interest spreads, as evidenced by recent research and census reports.

Research indicates that banks leveraging AI have broadened their lending to a more diverse range of borrowers, lowered default rates, and offered more attractive interest rates. Simultaneously, AI is setting new standards for speed, efficiency, and customer experience, potentially adding an estimated $2 trillion to the global economy.

Enhancing Financial Inclusion for Small Businesses

AI is breaking down barriers for small businesses that have historically struggled to secure funding. Digital lending platforms powered by advanced algorithms are making it easier for entrepreneurs to access capital that was previously out of reach.

Automated approvals and smarter risk scoring are promoting financial inclusion. In emerging markets, the combination of technology and human support has facilitated the rapid issuance of fast, affordable loans with repayment rates exceeding 94%.

More adaptive systems are also helping to reduce bias and friction, ensuring a broader range of businesses receive the funding necessary for growth.

We earn a commission if you make a purchase, at no additional cost to you.

Noteworthy Case Studies

- Fintech startup Affiniti recently secured $17 million in Series A funding for its AI-driven expense management platform, providing advanced analytics tools to millions of small businesses in the US.

- The $2 billion merger between Columbia Banking System and Pacific Premier Bancorp showcases how banks utilize advanced technology and M&A strategies to expand their regional presence.

Strategies for Accessing Non-Repayable Funds

Efficient Ways to Secure Capital

Lending platforms are streamlining the process for small businesses to connect with suitable lenders quickly. By analyzing actual financial data, these systems recommend banks, SBA lenders, or alternative funding sources that align with each company’s goals and circumstances.

For instance, FINSYNC’s Funding Navigator matches business owners with lenders based on industry, timing, and objectives, simplifying and enhancing the search for capital.

With enhanced data and sophisticated analysis, funding decisions are becoming more efficient, precise, and dependable. As AI transforms the financial landscape, risk is no longer just a concern to manage; it is evolving into an opportunity, opening up new avenues to capital for businesses of all sizes.

Image by rawpixel.com on Freepik

-

Facebook4 months ago

Facebook4 months agoEU Takes Action Against Instagram and Facebook for Violating Illegal Content Rules

-

Facebook4 months ago

Facebook4 months agoWarning: Facebook Creators Face Monetization Loss for Stealing and Reposting Videos

-

Facebook4 months ago

Facebook4 months agoFacebook Compliance: ICE-tracking Page Removed After US Government Intervention

-

Facebook4 months ago

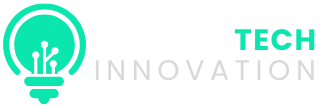

Facebook4 months agoInstaDub: Meta’s AI Translation Tool for Instagram Videos

-

Facebook2 months ago

Facebook2 months agoFacebook’s New Look: A Blend of Instagram’s Style

-

Facebook2 months ago

Facebook2 months agoFacebook and Instagram to Reduce Personalized Ads for European Users

-

Facebook2 months ago

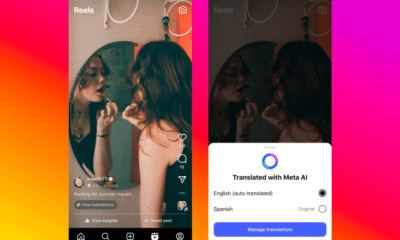

Facebook2 months agoReclaim Your Account: Facebook and Instagram Launch New Hub for Account Recovery

-

Apple4 months ago

Apple4 months agoMeta discontinues Messenger apps for Windows and macOS