AI

Unlocking the Potential: Understanding XRP’s Role in ETF-Driven Markets through AI

In recent times, the cryptocurrency market has undergone a significant transformation. Gone are the days when prices would react swiftly to headlines and sentiment changes. Today, the market moves at a slower pace, influenced by various factors such as capital allocation, ETF mechanics, and macro positioning. These forces, while not always overt, now play a crucial role in shaping price behavior, often overshadowing short-term fluctuations.

This shift in dynamics is particularly evident when examining XRP. The current XRP price reflects decisions made by institutions, fund managers, and regulators, alongside trading activities. AI tools are increasingly utilized to track these inputs, though their purpose is often misconstrued. Rather than predicting outcomes, these tools serve to organize the complexity of the market.

Recognizing this distinction fundamentally alters the way one interprets market trends.

Decoding an ETF-Driven Market with AI

AI systems prioritize identifying relationships over narratives. In the realm of cryptocurrency markets, this involves mapping ETF inflows and outflows against derivatives positioning, on-chain activities, and traditional asset movements. What sets the current scenario apart is the amplified significance of these signals.

According to Binance Research, altcoin ETFs have observed over US$2 billion in net inflows, with XRP and Solana leading the charge. Conversely, Bitcoin and Ethereum spot ETFs have experienced consistent outflows since October. This environment is marked by selectivity, caution, and unevenness, rather than the traditional risk-on sentiment.

AI models excel in identifying shifts in behavior, focusing on rotation rather than momentum. They pinpoint where capital is being reallocated even amidst price stability. This explains why markets may seem calm on the surface while significant positioning adjustments occur beneath.

AI merely indicates movement, refraining from providing causal explanations.

Insights from AI on XRP

XRP often diverges from the broader market trends. When circumstances change, its price tends to respond to factors like accessibility, regulation, and liquidity before sentiment catches up. This pattern has recurred, prompting AI systems to emphasize fund flows and market depth over short-term sentiment shifts in analyzing XRP.

Binance Research has highlighted early 2026 as a period where liquidity is resurging without a clear return to risk appetite. Capital has shifted away from crowded trades, yet replacements are not rushed. AI swiftly detects this imbalance, elucidating why XRP garners ETF interest even amid subdued cryptocurrency momentum.

This observation does not imply speculation but rather presents a snapshot of prevailing conditions. While market discussions may dwindle, headlines may fade, and prices may drift, underlying positioning continues to evolve. This aspect is easily overlooked when attention is solely on visible market activities.

AI’s neutrality proves beneficial here, as it bypasses spikes in engagement or sudden narrative changes, focusing on investors’ actual actions. In a domain where perception often precedes reality, this distinction holds greater significance than initially perceived.

Limitations of AI in Market Analysis

Despite its analytical prowess, AI possesses blind spots, with regulation being a critical one. Models rely on historical data, whereas regulatory decisions rarely adhere to historical patterns.

Richard Teng, Co-CEO of Binance, addressed this challenge following the exchange’s acquisition of its ADGM license in January 2026. He emphasized the significance of meeting stringent regulatory standards and the impact on market sentiment. Developments of this nature can swiftly alter market confidence, yet forecasting such outcomes beforehand proves arduous.

AI excels post-regulatory decisions but struggles in anticipation. For XRP, where regulatory clarity significantly influences past price trends, this drawback holds substantial weight.

Another drawback is AI’s inability to decipher intent. While it can gauge flows, interpreting why investors opt for caution, delay, or restraint remains outside its purview. Defensive posturing may not manifest dramatically in data, yet it can significantly shape markets over prolonged periods.

The Role of Human Judgement in Market Dynamics

AI complements rather than replaces human interpretation. Binance Research characterizes the current environment as one of liquidity preservation, with markets awaiting clear catalysts such as macroeconomic data releases and policy signals. AI can identify these moments of tension but cannot forecast whether they will translate into actions or prolonged stagnation.

Rachel Conlan, CMO of Binance, alluded to the industry’s maturation during Binance Blockchain Week Dubai 2025, highlighting a shift towards a more constructive market ethos over mere spectacle. This paradigm equally applies to AI utilization, emphasizing informed judgement over mere prediction.

Implications for Price Analysis

When leveraged effectively, AI unveils underlying forces often overlooked in ETF-dominated conditions. It illuminates capital movements, discrepancies between narratives and behaviors, and the validity of patience as a strategic choice.

Nonetheless, AI cannot eliminate uncertainty. In markets dictated by regulation, macro shifts, and institutional decisions, human judgement remains paramount. Optimal insights emerge from combining machine analysis with human context.

Image credit: Unsplash

-

Facebook4 months ago

Facebook4 months agoEU Takes Action Against Instagram and Facebook for Violating Illegal Content Rules

-

Facebook4 months ago

Facebook4 months agoWarning: Facebook Creators Face Monetization Loss for Stealing and Reposting Videos

-

Facebook4 months ago

Facebook4 months agoFacebook Compliance: ICE-tracking Page Removed After US Government Intervention

-

Facebook4 months ago

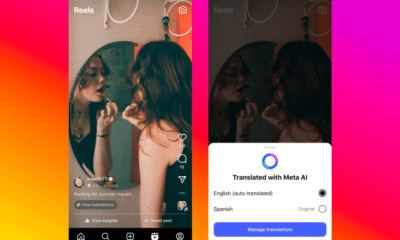

Facebook4 months agoInstaDub: Meta’s AI Translation Tool for Instagram Videos

-

Facebook2 months ago

Facebook2 months agoFacebook’s New Look: A Blend of Instagram’s Style

-

Facebook2 months ago

Facebook2 months agoFacebook and Instagram to Reduce Personalized Ads for European Users

-

Facebook2 months ago

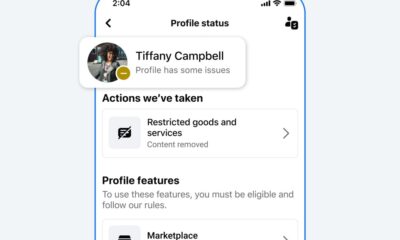

Facebook2 months agoReclaim Your Account: Facebook and Instagram Launch New Hub for Account Recovery

-

Apple4 months ago

Apple4 months agoMeta discontinues Messenger apps for Windows and macOS